Write a short note on Absolute and Comparative cost difference.

Absolute Cost Difference:

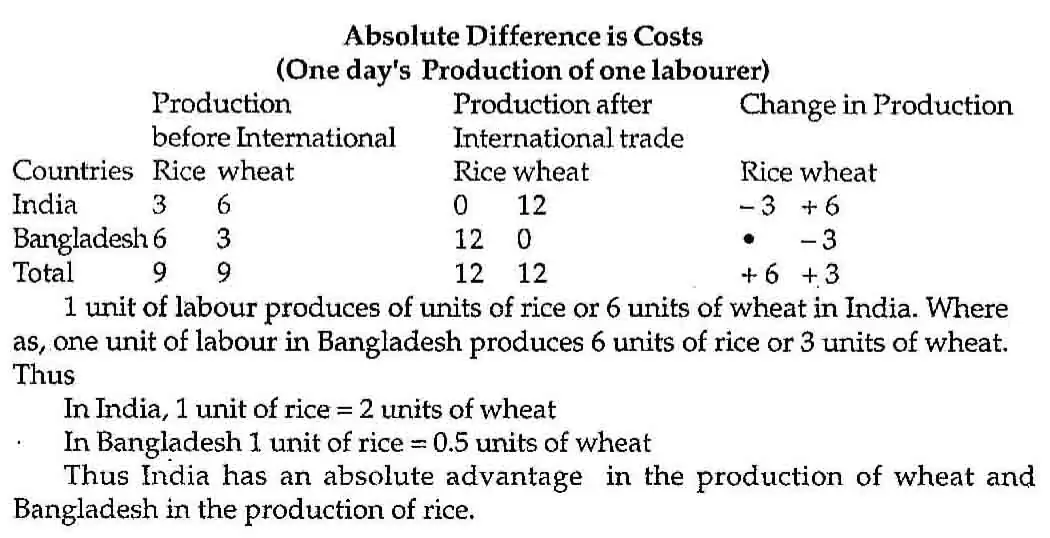

According to Adam smith, absolute differences in the cost of production of different goods across different countries is the basic reason behind the international specialization and trade. The absolute cost difference arises when one country is in a position to produce at a very low cost compared to another country and the other country can produce some other commodity at a very low cost compared to the first country. This becomes possible when a country is endowed with a special kind of soil, climatic conditions and facilities A nation specializes in the production of a particular commodity and exports it to other countries and imports another commodity form another country in Which the latter specializes.

A country is said to enjoy absolute cost advantage over the other country in the production of a commodity if it uses fewer resources to produce a given quantity of output.

Comparative Cost Differences:

Comparative Cost Differences in cost imply that one of the two countries has an absolute advantages in production of both the commodities, but its advantages is comparatively greater in the production of one commodity than in the other. The theory states, a country will specialize in the .production of that good in which it has comparatively more advantages, and will depend upon the trade partner for that good in whose production it has comparatively in disadvantages.

Let us illustrate if with the help of an example suppose, A month’s labour in India can produce in units of Rice or 100 units of wheat. A months labour in Bangladesh can produce 40 units of rice or units of wheat. It would be seen that India has an absolute advantages over Bangladesh in the production of both rice and wheat. But in production of rice India has comparatively more advantage over Bangladesh than the production of wheat. This can be done by comparing the cost ratios of the two commodities in the two countries:

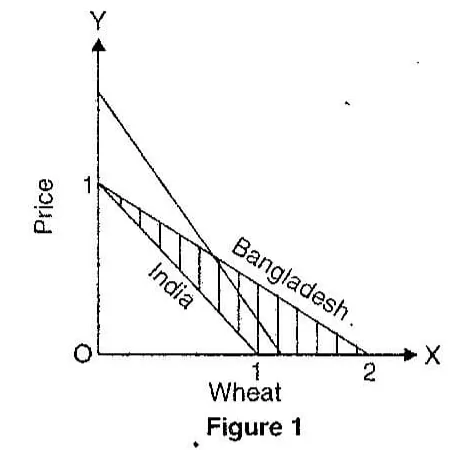

India will gain from trade as long as it can get more then 1 unit of wheat in exchange of 1 unit of rice. Bangladesh will gain from trade as long as it can get one unit of rice in exchange of less then 2 units of wheat. The terms of trade will come to be established between 1 unit of rice 1 to 2 units of wheat (none then 1 unit is the minimum, and less then 2 units is the maximum) depending upon the reciprocal demand of wheat in India, and rice in Bangladesh.

Using the concept of Opportunity cost, we can draw the production possibility curve as in figure 1. The shaded area shows the total gains that will accrue to the two nations, and will be distributed among them on the basis of their terms of trade which, in turn, will be determined by reciprocal demand.

The total gains that will accrue to both the nations can also be calculated arithmetically. Suppose, each country has two months labour available with it Without specialization.

India will produce:

100 units of Rice + 100 units of wheat

Bangladesh will produce

40 units of rice + 80 units of wheat

That is the total production of two countries will equal 140 units of rice

plus 180 units of wheat

After specialization.

India will produce

200 units of rice

Bangladesh produce

160 units of wheat

The total gain to the two nations will equal

(200R + 160w) – (140 R + 180w) = (60R – 20 w)

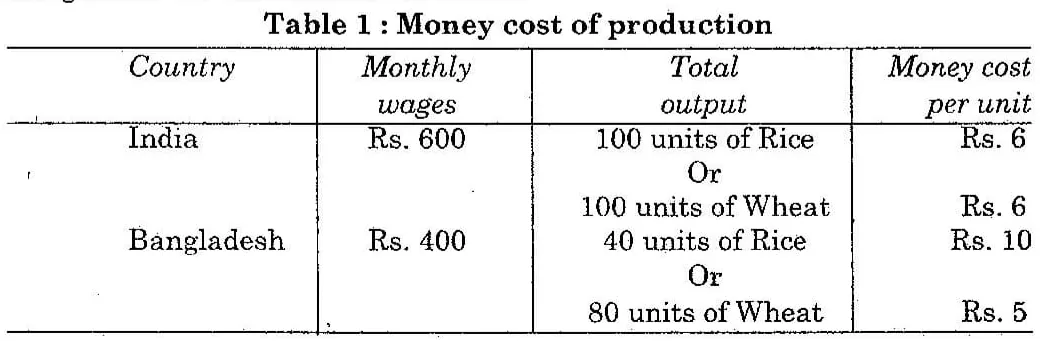

Let us convert this example into money terms by assigning money wages to labour. Let us suppose the monthly wage rate in India is Rs. 600 and in Bangladesh. It is Rs. 400. The money cost of producing wheat and rice in India and Bangladesh can be tabulated as follows:

As it can seen from table 1, the money cost of production of wheat is lower in Bangladesh then in India. The money cost of production of rice is lower in India then in Bangladesh. Bangladesh, thus, will specialize in the production of wheat, where as India will specialize in the production of rice. It may be observed that the introduction of money costs does not affect the conclusions we had earlier reached.

In our illustration above, we have arbitrarily fixed the money wayes in both, India and Bangladesh. However, that does not affect our conclusion as long as the money wage rates remain between the upper and lower limits determined by the relative costs of production of the two commodities in the two countries. If the wage rate Rs. 600 in India, the wage rate in Bangladesh cannot be less then 6/10 Rs. 600 := Rs. 360. Because the ratio of labour cost of producing rice in India and Bangladesh is Rs. 10 : Rs. 6. In case the wage ratio in Bangladesh falls to less then Rs. 360 per month.

The cost of production in terms of money and hence price of rice will become lower in Bangladesh then in India. Now, Bangladesh will start exporting rice to India instead of importing it. That means, Bangladesh will export both rice and wheat and import none.

This will make India’s balance of payments is on favorable. The automatic mechanism of international adjustment will push up the wage rate and price in Bangladesh, till they reach the level of Rs. 360 at which point again, both the countries will gain from international specialization. There will be a net gain of 40 units of rice from this type of specialization and division of labour.

Conclusion of the theory of comparative costs as follows:

- If cost ratios of production are the same in the two countries trade will not be advantages to either of them.

- In conditions of absolute cost differences trade between the nations will take place, but, then, it is not necessary that absolute differences in costs may be obtained between the nations.

- In conditions of comparative cost differences, it will be to the advantages of the trading nations if each specialize in the production

of that good in which it has comparatively more advantages, and for other goods it should depend upon the trade profits.

The theory of comparative costs expressed in terms of money:

The classical version of the theory of comparative costs has been explained in terms of the labor cost of production. In the modern exchange economics. Which are characterized by high degree of complex division of labor, cost of production is no longer expressed in terms of labour units. Instead monetary units are made use of the express the cost of production of a commodity. Therefore, it is necessary that cost differences are explained in money terms. Prof. Hablerler has shown how to translate comparative cost differences into absolute difference in prices and how such a translation would not alter the exchange relations.