What do you understand by price discrimination in monopoly?

Price discrimination means selling a good to different buyers at two or more price for reasons not associated with difference in cost, goods are assumed to be identical in nature. In the words of J. S. Bains, “Price discrimination refers strictly to the practice by a seller to charging different prices from different buyers for the same good.” According to Koutsoyiannis, “Price discrimination exists when the same product is sold at different prices to different buyers”.

Conditions : Price discrimination is possible under following conditions:

- Different markets have different price elasticities of demand.

- It is possible to partition total market by segregating buyers into groups Or sub -markets according to elasticity.

- Control over supply : The supply is in full control of the monopolist. It also Implies that no resale is possible among the market.

- It is profitable to discriminate.

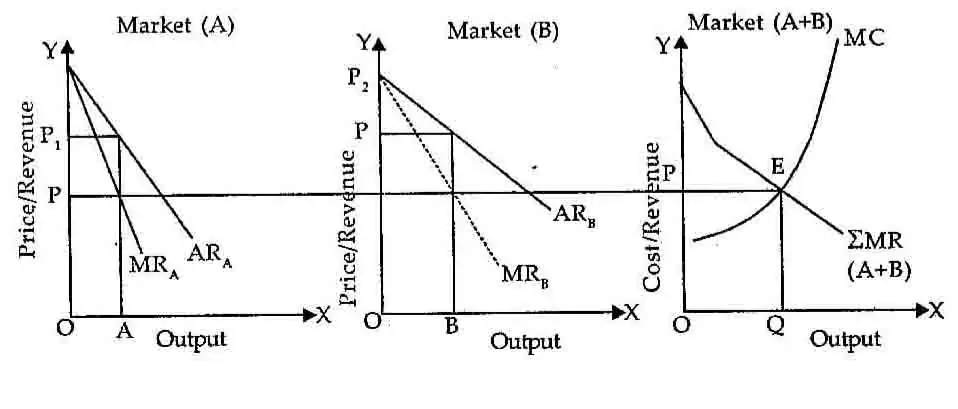

Price Determination under Price Discrimination : Price determination under discriminating monopoly is illustrated in figure. Supposing market is divided into two parts ‘A’ and ‘B’. As is evident from the slopes of ARA and ARB demand is less elastic in market ‘A’ than in market ‘B’. In this figure, ARA curve and ARB, curve are the demand curves of market ‘A’ and ‘B’ respectively. The combined equilibrium position of both the markets is shown in figure (A and B).

Obviously, the equilibrium of the monopoly firm will be at point E where combined MR is equal to MC of the total output OQ. The monopolist will so distribute his total output OQ in two markets that MR of each market is the same. If MR is less in one market and more in the other, then it will be profitable for monopolist to transfer commodities from less -MR market to -more -MR market.

For the equality of MR in different market, the monopolist will sell OA quantity of output in market ‘A’ and OB quantity in market ‘B’. He will sell less quantity in market ‘A’ at OP1 price and more in market ‘B’ at OP2 price. Total quantity of output in two markets, i.e., OA+ OB will be equal to the total output OQ produced by the monopolist.

It is clear from fig. that (i) marginal cost of total output is equal to combined marginal revenue, (ii) marginal revenue of both markets is equal, (iii) marginal revenue of both markets is equal to marginal cost of total output.

It is evident from fig. that elasticity of demand in market ‘A’ is less than market ‘B’. Thus in market ‘A’ price will be more and quantity sold will be less than in market ‘B’. In other words, Price is higher is less elastic market and lower in more elastic market.