Explain the term Over Subscription. How is it dealt in a accounting records?

Over Subscription:

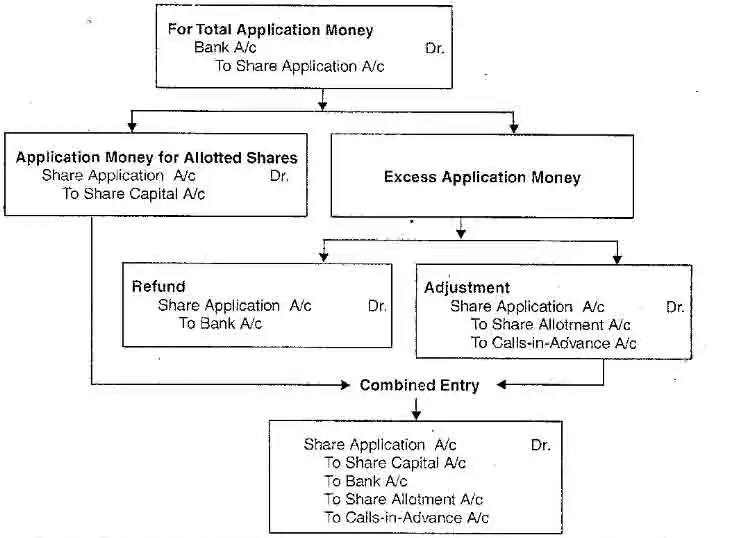

When the application money is received for more number of shares then the number of shares offered to the public by a company, it is called over-subscription. When the shares are over-subscribed, the company cannot satisfy all the applicants. This is because, the total number of shares to be allotted will, in no case, exceed the number of shares available for issue.

In the case of over subscription, following three possibilities arise:

Some applicants may not be allotted any shares. In other words, excess applications are rejected outright and their application money is refunded. This is known as Rejection of Applications.

Applicants may be allotted shares in a fixed proportion. This is called Partial or Pro-rata Allotment. For example, a company offers to the public 1,00,000 shares for subscription. The company receives application for 2,00,000 shares. If the shares are to be allotted on pro-rata basis, applicants for 2,00,000 shares are to be allotted 1,00,000 shares, i.e., in the ratio of 2,00,000: 1,00,000 or 2 : 1. Any applicant who has applied for 2 shares will get 1 share. In case of pro-rata allotment, the excess application money received is adjusted against the amount due on allotment or calls.

The directors may adopt a combination of the above two alternatives. Some applications may be accepted in full, some applications may be accepted rejected and hence a proportional allotment may be made to the remaining.