Explain the effect of a Tariff for a Small country.

Effect of a Tariff for a Small Country:

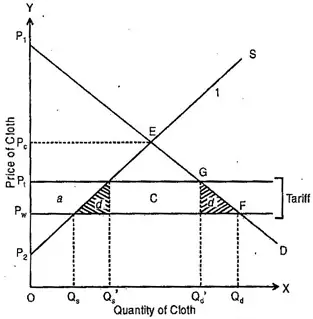

Suppose a domestic government in an effort to restrict imports, imposes a tariff on cloth imports. The imposition of a tariff of amount T on cloth imports be shown in following figure:

A small country is a country which cannot influence world market conditions. The world price of cloth is constant at Pw. The imposition of tariff raises the price of cloth in the country by the full amount of the tariff T and the price of cloth rises from Pw to Pt. The effect of the tariff results in a new equilibrium at G. The higher price of imported cloth has two effects:

The quantity imported falls from the horizontal difference Od Os to the smaller amount Od Os. The decline in imports is a result of lower consumption of cloth Qd to Qd and greater domestic production Qs to Qs.

The consumer is clearly worse off. The price of cloth has increased and the quantity of cloth consumers buy has declined. As a result, consumer surplus has declined. Thus, consumers lose as a result of a tariff.

The rectangular area “C” represents the tariff revenue that government collects. The quantity imported after the tariff is imposed is the horizontal difference between Qs and Qd. Multiplying the quantity imported times the tariff gives us total tariff revenue of area “C”. The government gains this area and consumer loses it. If it is assumed that the utility derived from government spending is the same as that derived from private consumption, there is no loss to the society as a whole from the consumer losing area “C” and the government gaining it.

Area “a” is a transfer of surplus from the consumer to the producer and domestic producers gain. From the point of view of the cloth producer, a tariff is not, as good as autarky, but it is preferable to free trade. The small triangle “b” represents the cost of resources transferred from their best use to the production of more cloth—Qs to Qs.

This represents a loss to society because in a free market these resources would have been used to produce a product in which the country has a comparative advantage. Transferring resources to the tariff ridden industry necessarily entails a loss of resources to some other more productive industry. Finally, the area “d” is a consumption effect caused by a tariff as consumers purchase less cloth Qd to Qd.

The areas “a” and “c” are redistribute from consumers to the producers and government respectively. The net loss less to the society and loss of consumer welfare is composed of area “b” + “d” . This loss to society is known as “dead weight loss”.